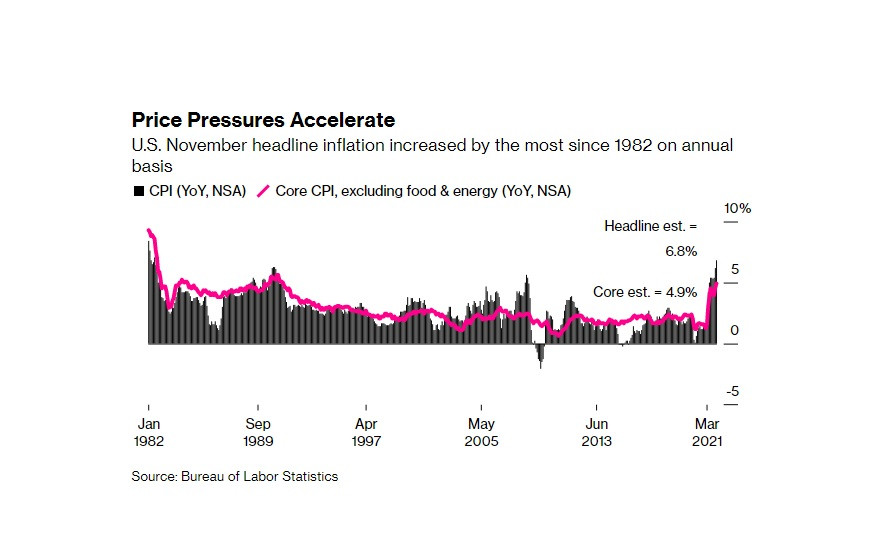

The previous month was a record for retail prices in the United States for almost 40 years. Rapid and persistent inflation undermines employers' salary funds and increases pressure on the Federal Reserve to tighten monetary policy.

According to the Ministry of Labor, published on Friday, the consumer price index increased by 6.8% (data for the year starting from November 2020 inclusive). The widely watched inflation indicator has risen 0.8% since October, exceeding economists' forecasts and continuing the trend of significant increases that began earlier this year.

The average forecast figures provided for an annual increase of 6.8% and an increase of 0.7% on a monthly basis. The yield on 10-year Treasury bonds declined, futures on the S&P 500 index rose and continue to rise. The dollar fell at the time of the opening of the New York session, as the indicators as a whole turned out to be no worse than expected. But let us recall that these expectations were adjusted to take into account a serious increase in October.

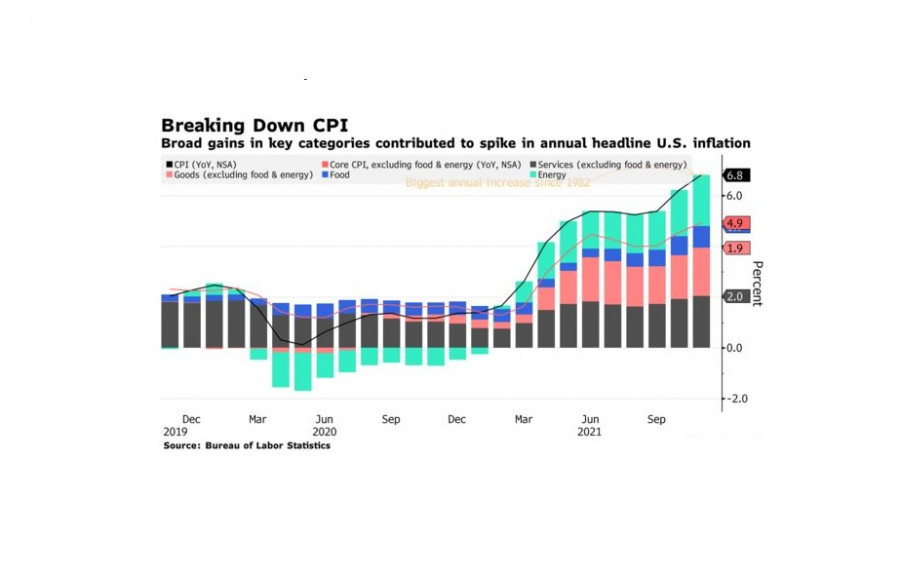

The increase in CPI reflects a significant increase in most categories. Gasoline, housing, food, and cars contributed the most to the growth compared to the previous month.

These data lead investors to expect that the Fed will accelerate the winding down of its bond-buying program at the final meeting of the central bank this year next week. Governments in most countries are now under increasing pressure to deal with rising inflation as workers spend more at grocery stores and gas stations.

This figure "just puts pressure on the Federal Reserve," Kathy Bostjancic, a chief financial economist at Oxford Economics, said on Bloomberg Television. "This is a very difficult period for them."

Inflation "will remain hot and sticky during the first quarter", she believes.

A faster rate cut would open up an opportunity for the Fed to start raising the benchmark interest rate. At the same time, investors bet on a sharp increase in Fed rates in 2022, pointing out that Friday's data showed a higher chance of slowing inflation, given that the monthly change was less than in October.

Annual CPI growth is expected to be around 7% by 2022.

Core inflation

Excluding food and energy, base prices increased by 0.5% compared to the previous month. Overall, the core consumer price index rose by 4.9% compared to last year, reaching a new 30-year high.

The cost of housing, which is considered the most significant component of the CPI and accounts for about a third of the overall index, increased by 0.5% in November compared to a month earlier.

Compared to the same month last year, the 3.8% increase was the largest since 2007. Housing costs are expected to rise next year as rent increases follow property prices, with a slightly delayed effect.

Furniture, clothing, and airline tickets also contributed to the rise in inflation.

Household consumption increased by 6.4% compared to last year, which is the highest since December 2008. Total spending on food, including away from home, increased by 6.1% compared to a year earlier - the highest since 2008.

Gasoline rose by 6.1% compared to the previous month, which corresponds to the volume of growth in October.

The rental of basic housing and the equivalent rent of owners increased by 0.4% from October.

As a result of a serious price increase and a tumultuous policy regarding the Ukrainian-Russian conflict, Joe Biden's approval rating fell, which increased political pressure on the administration, forcing the president's entourage to move more actively.

And although the White House has taken some steps - for example, creating a task force on the supply chain - inflationary pressures continue to grow. Rapid inflation is also likely to affect the final size and fate of Biden's Build Back Better bill.

Next year, supply chain problems will continue to drive up prices in the short term, but economists expect this factor to disappear as Americans move to more normal consumption patterns. However, other factors, such as labor shortages and housing costs, can keep inflation at a high level.

According to David McLennan, chief executive officer of Cargill Inc., food prices are also likely to remain high next year.

"I thought that inflation in agriculture and food was temporary. Now I feel less because of the ongoing shortage in the labor markets," McLennan said last month in an interview at the Bloomberg New Economy Forum in Singapore. "This is one of the entrances to the supply chain that we are closely monitoring."

Wages have also been showing growth in recent months, but lagging behind consumption. The average hourly wage may show a nominal increase, but adjusted for inflation, the real level fell by 1.9% in November compared to a year earlier. This is the biggest rebound in six months.

Inflation or stagflation?

The growth of a new variant of coronavirus has raised concerns about a double blow to the US economy in the form of slowing growth on the one hand, and still high inflation on the other. While supply chains are collapsing after the collapse, local governments are considering new restrictions, and consumers are assessing not only the health risks in everyday life but also pre-holiday expenses.

And yet, so far, economists see the risk of "stagflation" - that toxic mixture of weak growth and strong inflation, which significantly worsens the prospects for recovery - by only half.

It is obvious that prices are rising more noticeably in the United States than anywhere else, but the growth rate has also turned out to be more stable than politicians expected. Now it is quite difficult to judge how far this growth is from stagnation, and whether it will continue next year at a rate above average, which can push Americans to look for work for several months.

The level of consumption in the United States reached pre-pandemic indicators in the previous reporting periods.

Still, some forecasters have lowered their forecasts for U.S. gross domestic product growth. As we know, the forecasts of Goldman Sachs and other banks for the next year have been regularly declining since spring. And there are no grounds for revision for the better yet: data on travel by US airlines, restaurant visits, and credit card expenses so far do not show obvious changes in recent weeks, since the risk of the Covid-19 threat persists.

But not everyone thinks so.

"We will not see stagflation. We will see an inflationary boom with continued strong growth and price growth rates, which have already prompted the Fed to reorient policy to contain inflation," Glenn Hubbard, chairman of the Economic Council, commented on this. Hubbard served as an advisor to former President George W. Bush and is now a professor of economics at Columbia University.

Median forecasts of economists showed that they expect growth in the United States in 2022 at the level of 3.9% (the forecast repeats the November one).

Federal Reserve policymakers will release their new forecasts next week at a meeting that is expected to begin with a proposal for tougher measures to ensure that inflation remains under control. These forecasts are likely to describe an economy approaching full employment next year and continuing to grow faster than before the pandemic.

The unemployment rate in November at 4.2% is already significantly lower than the level of 4.8% in September and is close to the level of 4%, which is considered sustainable in the long term.

Postcovid-economy

Policymakers may also start raising rates more quickly and approve plans to end current bond purchases in March, rather than in June 2022, as previously planned.

It is still too early to try to understand how the Omicron variant will behave, and how people will tolerate its distribution.

If it turns out to be faster, less dangerous to vaccinate, and as deadly as Delta, it could trigger a new wave of restrictions in some countries and plant closures or travel in others, potentially adversely affecting global growth and jobs.

"Countries simply cannot repeat the big monetary policy push, the big fiscal policy push that they have been able to make over the past two years. This cannot happen again," Gita Gopinath, chief economist at the International Monetary Fund, said at an event in Geneva on Thursday.

If the Omicron option causes a new and serious economic shock, "we will face a real risk of what we have avoided so far, namely stagflation."

But so far, markets, analysts, and economic data do not reflect such a worst-case outcome, partly because markets are tired of being afraid of new strains.

The latter option was first identified in early November. Since then, the weekly number of travelers allowed to fly to the United States by the Transportation Security Administration has remained about the same or slightly higher compared to 2019, as it was earlier in the fall. According to the OpenTable booking website, the volume of personal bookings in restaurants has also not changed.

This indicates that people are striving for greater openness and reduction of quarantine measures, tired of restrictions.

A recent study conducted by researchers at the San Francisco Fed noted what has become the main hope of politicians: American businesses and consumers are "used to the coronavirus."